Commercial Solar for NSW Businesses: How to Cut Operating Costs by 6%

Rising electricity costs are squeezing profit margins for NSW businesses across all sectors. Manufacturing facilities, retail stores, hospitality venues, and professional offices all face escalating energy expenses that directly impact their bottom line. Commercial solar offers a proven solution: businesses installing solar systems are achieving 40-60% reductions in electricity costs while simultaneously improving their brand reputation and environmental credentials. This comprehensive guide explores the financial and strategic benefits of commercial solar for NSW businesses, including ROI calculations, tax advantages, and government incentives designed specifically for commercial installations.

The Business Case for Commercial Solar

Unlike residential solar, which focuses on reducing household electricity bills, commercial solar delivers multiple financial and strategic benefits:

1. Immediate Operating Cost Reduction: Commercial solar systems offset 50-80% of daytime electricity consumption, directly reducing monthly operating expenses. For businesses with high daytime energy consumption (manufacturing, retail, offices), the savings are substantial.

2. Tax Advantages: Businesses can claim depreciation deductions on solar system investments, and many qualify for accelerated depreciation through the Instant Asset WriteOff (IAWO) scheme, reducing taxable income significantly.

3. Long-Term Price Certainty: By generating your own electricity, you insulate your business from future electricity rate increases, providing budget predictability and competitive advantage.

4. Enhanced Brand Value: Businesses demonstrating environmental commitment attract conscious consumers and employees, improving brand reputation and market positioning.

5. Government Incentives: Federal and state governments offer substantial rebates and incentives specifically designed to encourage business adoption of solar energy.

Understanding Commercial Solar System Sizing

Commercial solar systems range from 10kW (small retail) to 100kW+ (large manufacturing). System size depends on your facility's roof space, electricity consumption patterns, and budget.

Small Commercial (10-25kW): Suitable for retail stores, small offices, and professional services. Typical installation cost: $15,000-$40,000 (before rebates). Annual savings: $3,000-$8,000.

Medium Commercial (25-50kW): Suitable for larger offices, hospitality venues, and light manufacturing. Typical installation cost: $40,000-$80,000 (before rebates). Annual savings: $8,000-$18,000.

Large Commercial (50-100kW+): Suitable for manufacturing facilities, distribution centers, and large retail chains. Typical installation cost: $80,000-$200,000+ (before rebates). Annual savings: $18,000-$50,000+.

Financial Analysis: Commercial Solar ROI

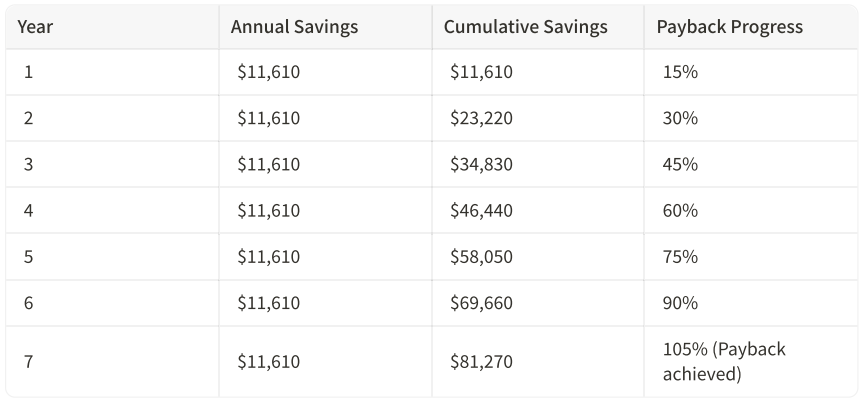

Case Study: 50kW System for NSW Manufacturing Facility

Facility Profile:

• Monthly electricity consumption: 15,000 kWh

• Current electricity bill: $2,250/month ($27,000 annually)

• Peak consumption: 8am-5pm (aligns with solar generation)

System Specifications:

• 50kW solar array

• Expected annual generation: 65,000 kWh

• Offset: 43% of annual consumption

• Installation cost: $95,000 (before rebates)

• Rebates available: $18,000-$22,000 (STCs + state incentives)

• Net installation cost: $73,000-$77,000

Financial Projections:

25-Year Financial Benefit: $290,250 in cumulative savings (assuming 2% annual electricity rate increases).

This facility achieves payback in approximately 6.5 years and enjoys 18+ years of essentially free electricity generation.

Government Incentives for Commercial Solar

1. Small-scale Technology Certificates (STCs)

Commercial solar systems up to 100kW qualify for STCs, providing immediate rebates at the point of installation. A 50kW system typically qualifies for $18,000-$22,000 in STCs. This rebate is deducted directly from your installation cost, reducing your net investment significantly.

2. Instant Asset Write-Off (IAWO)

Businesses can claim an immediate tax deduction for solar system investments up to $20,000 (or higher depending on current thresholds). This deduction reduces your taxable income in the year of installation, providing immediate tax benefits.

3. Depreciation Deductions

For systems exceeding IAWO thresholds, you can claim depreciation deductions over the system's useful life (typically 10-15 years). This spreads the tax benefit across multiple years, reducing taxable income annually.

4. State-Specific Incentives NSW offers additional incentives through various programs designed to encourage business adoption of renewable energy. Kratos Energy's team stays current on all available state incentives and ensures you maximize your benefits.

Maximizing Commercial Solar ROI

1. Align System Size with Consumption Patterns

Oversizing your system wastes investment on excess generation you don't use. Conversely, undersizing limits your savings potential. Conduct a detailed energy audit to right-size your system for maximum ROI.

2. Optimize Consumption Patterns

Shift high-consumption activities to daylight hours when solar generation is peak. For example, manufacturing facilities can schedule energy-intensive processes during midday when solar output is highest.

3. Combine with Battery Storage

Commercial battery systems store excess daytime generation for use during evening peakrate periods. This amplifies savings, particularly for businesses with evening operations.

4. Leverage Government Incentives Fully Work with your installer to identify and claim all available rebates, tax deductions, and incentives. Kratos Energy's team has extensive experience navigating commercial solar incentive programs.

5. Monitor and Optimize Performance Modern commercial solar systems include real-time monitoring dashboards. Regularly review your system's performance and identify optimization opportunities.

Case Study: Retail Chain Achieves % Cost Reduction

Business: 8-store retail chain across NSW Combined electricity bill: $180,000 annually Solar system installed: 75kW across all locations Installation cost (after rebates): $110,00 Tax deductions claimed: $22,000 (immediate IAWO benefit)

Year 1 Results:

• Electricity bill reduced to $72,000 (60% reduction)

• Annual savings: $108,000

• Tax benefit: $22,000 (net cost: $88,000)

Payback period: Less than 1 year (including tax benefits) 25-year savings: $2.7 million+

This retail chain achieved payback in less than one year through a combination of energy savings and tax benefits, making commercial solar an exceptional investment.

Addressing Commercial Solar Concerns

"Will solar panels damage my roof?"

Professional solar installers use non-penetrating mounting systems that distribute weight evenly across your roof. Regular inspections ensure your roof remains in excellent condition. Most quality installations come with roof warranties.

"What happens if my business relocates?"

Solar systems are permanent fixtures, but they can be relocated or removed. Discuss relocation options with your installer. Many businesses find solar systems enhance property value, making them attractive to potential buyers or tenants.

"How does solar affect my electricity supply?"

Your business remains connected to the grid, ensuring uninterrupted power supply. Solar generation supplements grid electricity, reducing your consumption and costs. During cloudy days or nighttime, the grid provides all necessary power.

"What about maintenance costs?"

Commercial solar systems require minimal maintenance—typically annual inspections and occasional cleaning. Maintenance costs are negligible compared to energy savings, usually less than % of annual savings.

Commercial solar represents a compelling investment for NSW businesses seeking to reduce operating costs, improve profitability, and enhance environmental credentials. With government incentives, tax advantages, and rapid payback periods, commercial solar delivers exceptional financial returns while supporting your sustainability goals. Whether you operate a small retail store or a large manufacturing facility, a properly sized and installed commercial solar system can reduce your electricity costs by 40-60% while positioning your business as an environmental leader.

Contact Kratos Energy today for a free commercial solar assessment. Our experts will analyze your facility's energy consumption, design an optimal system, and calculate your specific ROI. Let's transform your business into an energy-efficient, profitable operation.